Where patient satisfaction was once solely measured from a clinical standpoint, patients now regard the financial side of the house as an important part of the overall experience. Increasingly, they’re judging and rating their satisfaction with healthcare organizations by the amount of repeat business and referrals they bring.

A study we recently conducted to measure awareness, loyalty and satisfaction with consumer-friendly patient loan programs and the role they play in creating a positive hospital experience for patients reveals some not-so-surprising insights.

The second annual Healthcare Consumerism Study was built on an effective model established in 2015 by the Lavin Entrepreneurship Center at San Diego State University. This year, healthcare market specialist Porter Research designed and administered the survey. In addition, the advice of the CFO from a major health system was also solicited in this year’s study.

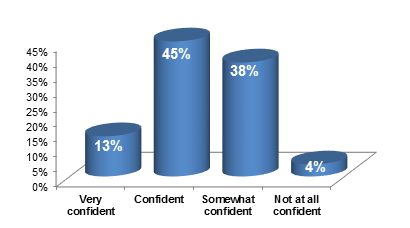

The survey was completed by more than 2,700 patients, representing a 78 percent completion rate. This statistically significant response rate provides the survey data with a 95 percent (+/-2%) confidence rate.

Among respondents, healthcare cost is undeniably a concern: 79 percent say it is a factor when selecting a physician, and 81 percent confirm the same when choosing a healthcare provider.

Relative to their cost concerns, 91 percent of survey respondents regard healthcare as a “big ticket” expense that requires financing or some sort of payment plan of 12 months or more. In fact, one out of every three consumers would delay care if a loan program wasn’t made available to them. This is an increase from our 2015 Healthcare Consumerism study, when 26 percent of respondents said they would delay care. Moreover, the finding compares with a recent study by the Commonwealth Fund, which shows 40 percent of adults with deductibles equal to 5 percent or more of their income said they would not seek care due to cost. Experience shows that most patients are willing to pay their portion of care. They just want options to make repayment affordable.

One survey respondent said, “It’s helpful not to have to pay a large, unexpected medical bill all at once.”

Loyalty is an important barometer of future business. According to The Advisory Board Company, patients who return to a healthcare organization within 18 months generate six times more revenue for that provider. Making care affordable through a loan program is a clear benefit that will enhance goodwill, loyalty and referrals within a healthcare provider’s consumer and community base. According to the survey, 90 percent of respondents likely will return to the healthcare provider that offers a loan program, and 88 percent would likely recommend the healthcare provider to friends and family.

“I’m happy there’s a reasonable payment method to manage medical debt versus being turned over to a collection agency,” said a survey respondent.

Each interaction during a patient episode is an opportunity to create a longer-lasting relationship. It’s important to remember that an episode isn’t solely made up of the patient’s experience inside of the hospital’s four walls. Your outreach to patients before service and your follow-up for reimbursement are activities that impact their decision to return to your facility in the future.

For more information on consumer-friendly patient loan programs please contact Bruce Haupt, President and CEO, ClearBalance at bhaupt@clearbalance.org or Cynthia Porter, President, Porter Research at cporter@porterresearch.com.

Source: HFMA’s First Illinois Chapter Newsletter, October 2016